Find Winning Momentum Trades With This Moving Average Stock Screener

Moving averages are one of the most reliable tools in technical analysis — and now Barchart has added powerful new screener filters that help you identify rising or falling trends before the crowd catches on.

In this article, we’ll walk through exactly how to use these new tools to build smart, high-probability trade setups. Whether you're looking for breakout momentum or reversal plays, these tools can point you in the right direction.

What Are Moving Averages? And Why Use Them?

Moving Averages (MA) smooth out price data over time to help you clearly identify the direction of a trend:

There are two common types of moving averages used in technical analysis:

- Simple Moving Average (SMA): Based on the average closing prices evenly weighted across a defined period.

- Exponential Moving Average (EMA): Places more weight on recent prices, making it more responsive to changes in momentum.

That means SMAs are helpful for long-term trend confirmation, while EMAs are great for short-term momentum signals and reversals.

But here’s where things get exciting: Now you can track whether those MAs are sloping up or down — and by how much — directly inside the Barchart Screener.

How to Use the Screener to Spot Momentum

Head over to the Stock Screener under the “Stocks” tab.

From there, you can:

- Load a saved screener or build one from scratch

- Use pre-built Barchart screener templates to jumpstart your analysis

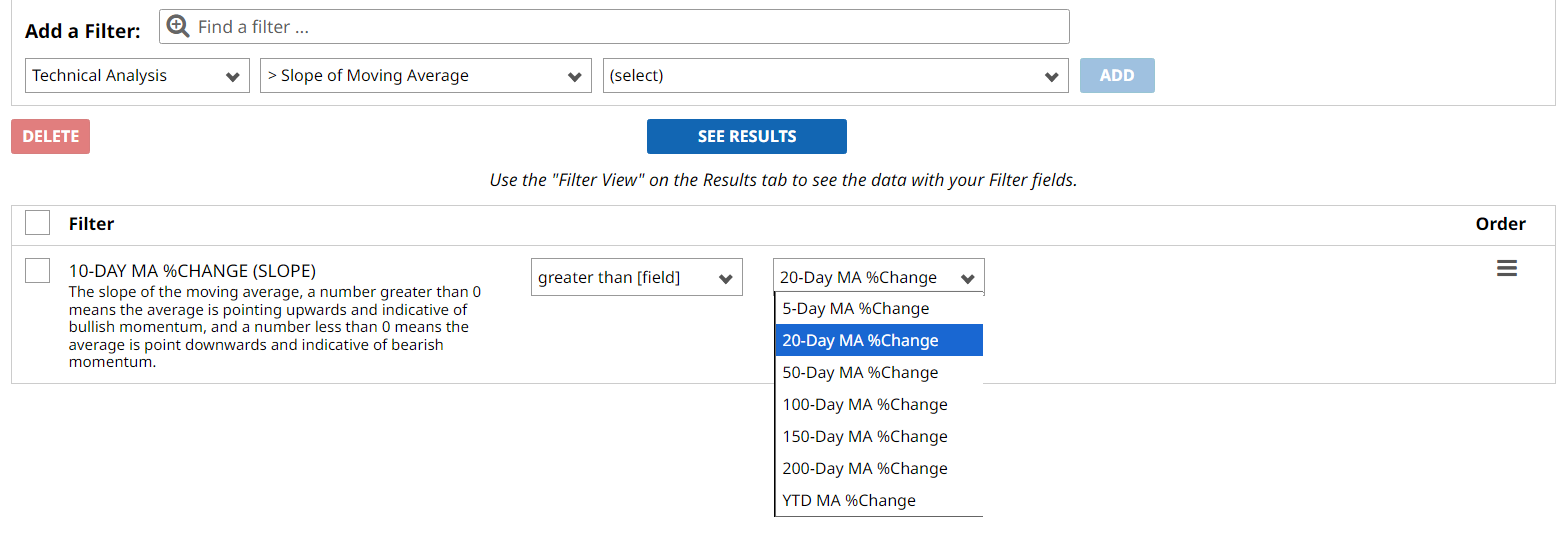

To build a custom screener with moving average filters, search and add filters for:

- 20, 50, 100, or 200-day Moving Average (or EMA)

- Slope of Moving Averages

- MA % Change or EMA % Change

Adjust your slope values:

- Positive slope (> 0): Indicates a rising trend

- Negative slope (< 0): Indicates a falling trend

Add optional filters like:

- Market Cap

- Average Volume

- Barchart Opinion or MA Signal (Buy/Sell)

Now you have a filtered list of bullish or bearish setups with trending MAs.

What the Slope Tells You (And Why It Matters)

A rising slope in a moving average means that the average price is accelerating upward — a sign of building momentum.

A declining slope means momentum is weakening, and prices could reverse or trend lower.

With these filters, you can:

- Catch breakouts when multiple MAs slope upward

- Spot potential tops or trend exhaustion when MAs begin to slope downward

- Avoid sideways chop by filtering for clear direction

Flipcharts + Chart Templates: See the Trend Instantly

Once your screener is built, click “Flipcharts” to scroll through interactive charts of your results.

Then, apply a Chart Template that includes your selected MAs (20, 50, 100, 200-day) for consistent analysis.

Pro Tip: Use the template with Comparative Relative Strength (CRS) to see how the stock compares to the overall market.

You’ll instantly see:

- Stocks with clean upward trends

- Reversals where price breaks below key averages

- Consolidation zones to avoid

Save Your Screener, Set Alerts, and Build Watchlists

Found a trade setup you love?

- Save your screener for future use

- Set alerts to get notified when new stocks meet your filter

- Add to a watchlist to track trade candidates over time

Bonus Tip: Use the New Recommendations Page

For even more trade ideas, head to the New Recommendations page under the Stocks tab.

Here, you’ll find signals based on:

- Trend Seeker®

- Moving Average crossovers

- Short and long-term MA setups

Use these ideas to launch deeper screening or start a new watchlist fast.

Final Thoughts: Why Moving Average Slopes Give You the Edge

Many traders use moving averages — but very few are filtering by their slope or rate of change.

These new tools let you:

- Filter for real directional movement

- Avoid sideways or noisy charts

- Visualize trends instantly

- Set alerts and stay ahead of the move

Whether you're trading daily breakouts or building long-term positions, the Moving Average Slope filters give you a powerful edge in screening the markets.

Watch the Video Tutorial: How to Use Moving Averages to Find Trades

For the full visual explainer, here's the video walkthrough:

Start Screening Now on Barchart »

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.